Using the code name ‘Project Colechurch’ the Marks Baughan financial group is currently pitching a ‘leading AI-driven contract review and analytics’ company to potential buyers across the market, indicating that one of the remaining independent contract AI businesses is soon to be sold.

Artificial Lawyer understandably was rather interested in this one and so has had a go at figuring out who it might be. Below is a list of some of the contract AI companies currently still in circulation, with thoughts about which one may be a good fit.

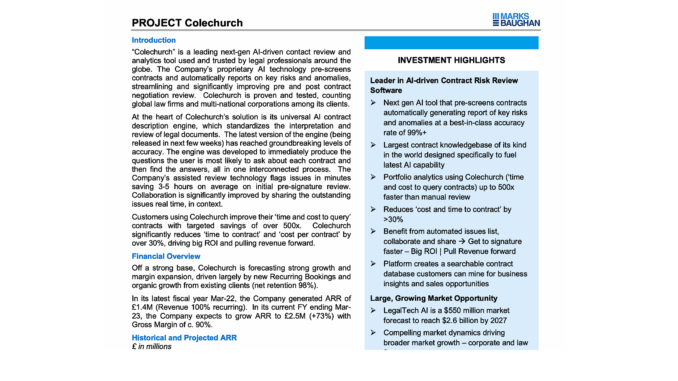

The Project Colechurch ‘teaser’, as the Marks Baughan team call it – in effect a pre-NDA blurb of top line information minus the company’s real name – gives several clues. It mentions:

- The company’s financial year ends in March – (you’ll see why this matters below).

- ‘The Company’s proprietary AI technology pre-screens contracts and automatically reports on key risks and anomalies’ – so that rules out several in the market that don’t really focus on pre-screening.

- ‘In its latest fiscal year Mar-22, the company generated Annual Recurring Revenues of £1.4m’ – and that also narrows the field, as several competitors are well beyond that revenue figure now.

- ‘At the heart of [this] solution is its universal AI contract description engine….[which] was developed to immediately produce the questions the user is most likely to ask about each contract and then find the answers, all in one interconnected process.’ – again this narrows the field, as not everyone has developed their own engine like this for contract analysis.

- And, it has around ‘40 clients’ – so that also excludes some others in the field.

So, who is out there still? Kira was bought, so too eBrevia, Leverton and Thought Trace. Still in the field, are:

- Della – no chance, as early days for them still, and they have only just raised and are embarking on a period of growth after getting their go to market strategy clear.

- Luminance – when this site first got sight of this, Luminance seemed like the obvious company to be on sale in the contract AI segment. But, it doesn’t fit. The revenues mentioned are below what Luminance has, the financial year is different, and the company doesn’t really focus so much on the whole pre-screen aspect of contracts. So, nope.

- Eigen – also doesn’t fit. Its revenues are higher than those noted, financial year also doesn’t fit, and also doesn’t focus on pre-screening. Eigen also only sees legal as one part of its offering, and works more with banks and insurance companies. So, nope.

- Diligen – the Canadian contract AI company mostly has a traditional post-deal review focus, so, probably no. Also data was given in GBP £, not CAN$.

- Lexical Labs – in some ways this fits better, as it does handle pre-signature review. But in this case the revenues are higher than it has, and filing data doesn’t match.

- LawGeex – the grandaddy of pre-screening review looks like another potential, however, they are based in Israel and the US, while the financial data is all in GBP £ and too low for them. Moreover, it’s understood that they have not retained these advisors, so not them.

- ThoughtRiver – now….this one is a good fit, and for several reasons.

Here is why ThoughtRiver is a good potential fit:

- Data is in GBP £, and ThoughtRiver is a UK company with filed financial data that does not look too out of step with the revenue figures given by the agents.

- The financial year quoted is the same, March year end.

- They were one of the first companies to provide AI-based pre-screening of contracts.

- They developed Lexible, a legal language framework that sounds a lot like the ‘universal AI contract description engine….[which] was developed to immediately produce the questions’, mentioned in the pitch document.

Artificial Lawyer contacted ThoughtRiver last night for a comment, but has not heard back at time of going to press today.

Conclusion

Given that no-one has confirmed they are the one for sale then we cannot be certain. But, the evidence does point towards ThoughtRiver. (If it’s not them, then we’ll just have to keep looking. Let us know guys.)

One other point is that this isn’t a great time to sell, given the way valuations have dropped. But, according to Crunchbase, ThoughtRiver last did a major fund raise ($10m) back in 2020. Without a large raise to follow soon, a sale would make sense. They have also been going some time now, starting back in 2016 – about six years, and some founders sell around that point.

Also, it’s worth noting that the pitch documents mention sale or ‘recapitalisation’, i.e. where a private equity company comes in and buys up the vast majority of the business and effectively cashes out the founders. Either way it’s an exit for the founders.

Whichever company it is, Artificial Lawyer wishes them the best of luck in finding a buyer. Every company mentioned above is doing great work and any buyer would be lucky to have them.

1 Trackback / Pingback

Comments are closed.