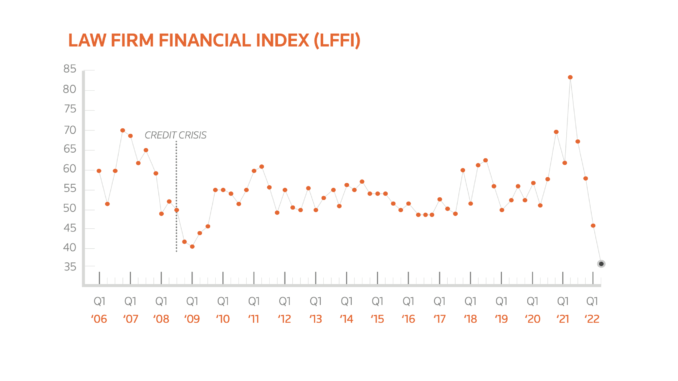

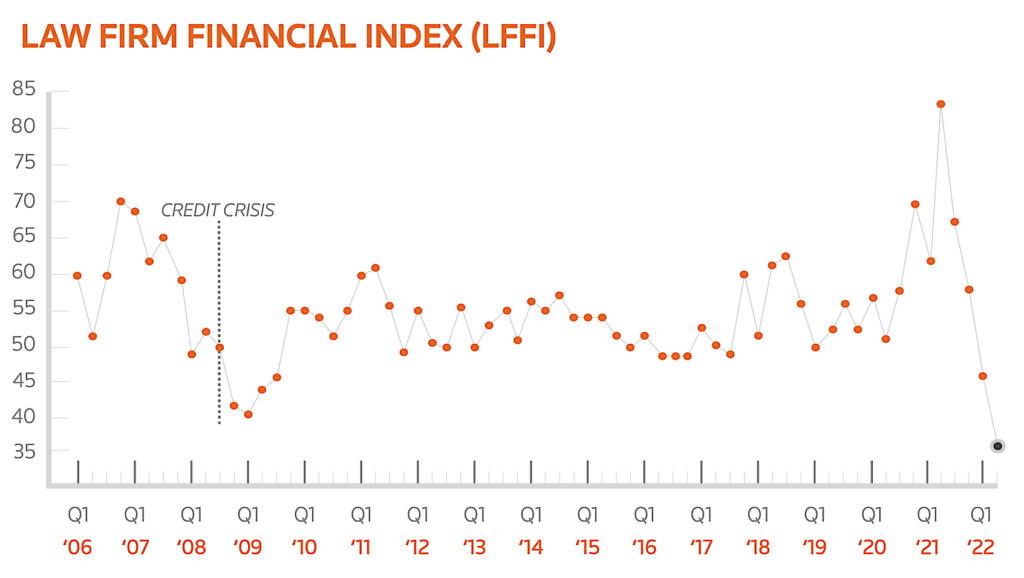

You can hear the squeal of brakes……as Thomson Reuters data shows that its Law Firm Financial Index (LFFI) has dropped to 36, down 10 points from last quarter, and down to its ‘lowest score ever’ – lower than even during the financial crisis of 2008 to 2010.

What is happening? The short answer is that a law firm is a finely tuned machine. When the market is up it creates profits faster than almost any other enterprise on the planet, but when it tips the other way, i.e. workflow reduces while costs remain high, then things tank very fast.

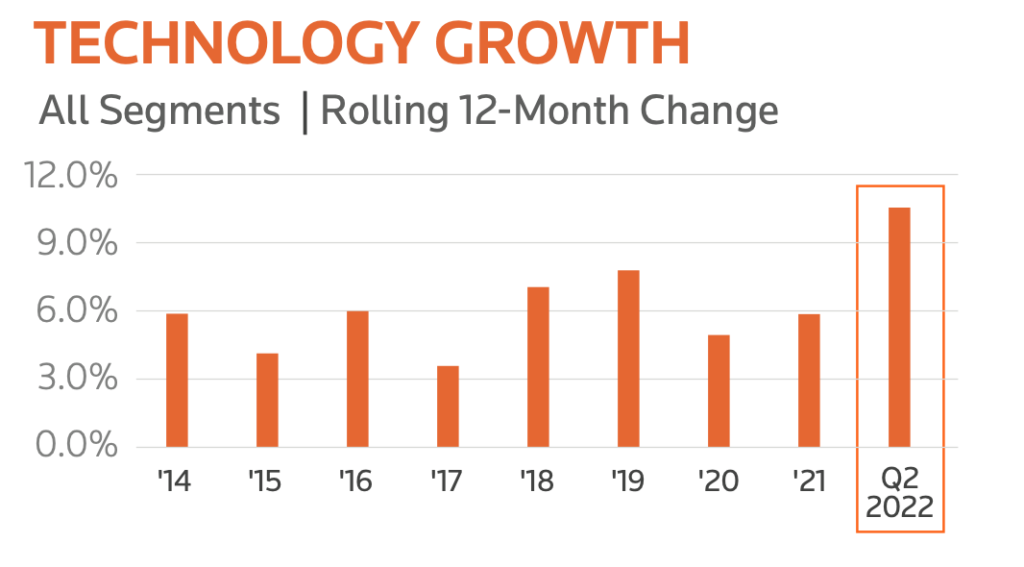

Things are all the more tricky now as after a period of incredible growth and high demand, which has pushed up salaries across most large firms, along with more use of offices, and higher spending on technology (see below), we now have a dip in activity as recessionary patterns start to take hold.

Moreover, one could add that because of high inflation, an increase in profits at large firms is actually not as impressive as it once might have been. I.e. inflation has meant that $1m made in 2020 to 2021 is really not anywhere close to $1m any longer in terms of real world spending power. In fact, firms that only made a small PEP increase could theoretically now be shrinking in terms of partner profits due to that inflation.

You can find the report here.