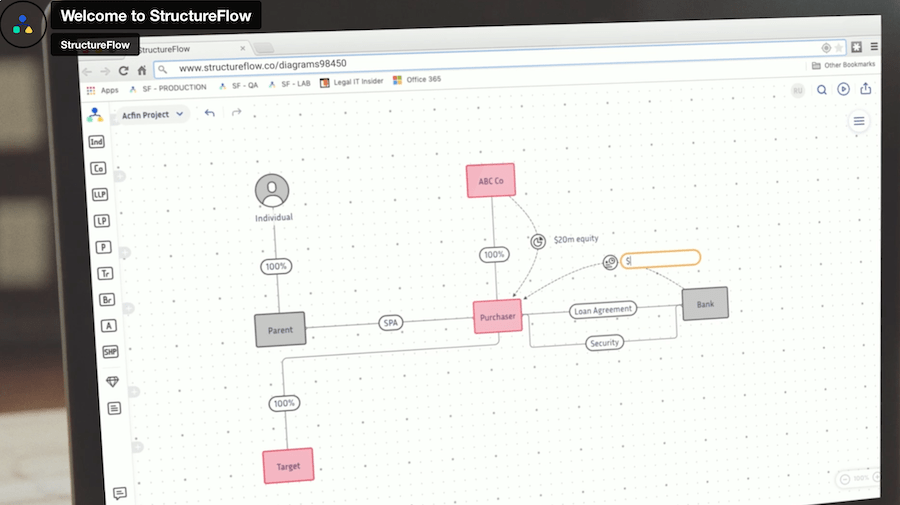

StructureFlow, which helps you to visualise deals with interactive digital flowcharts, has bagged $3.5m in a Pre-Series A funding round, amid what remains a tough market for venture capital investment. Artificial Lawyer spoke to CEO, Tim Follett, about how the funding unfolded and where the company is heading now.

But, before we dig in: UK-based venture capital firm Venrex led the round and several angel investors also participated, including Chris Adelsbach and Tariq Khan. Total investment is now around $8m.

—

– What was it like to raise funds in the current market?

I think there’s always potential to raise funds from VCs for a startup that demonstrates market traction, strong articulation of vision, and a good grasp of business model dynamics. But that’s not to say it’s easy to raise capital, far from it, and it’s fair to say that VCs are becoming far more selective at the moment. Capital is available, but the bull market has turned. For StructureFlow, our relationship with Founders Factory helped us to meet more VCs but I’m a firm believer that hard work and being super organised sets you up well to maximise the chances of success.

– Has your valuation changed since 2021?

It has increased, reflecting our continued revenue growth and customer acquisition. Over the last few years we have always raised money on a broadly consistent multiple of revenue. If revenue is going up we can justify a higher valuation, which is what existing investors want to see. Personally, I would rather err on a lower valuation that gets capital in with the least friction than be too caught up with justifying higher valuations and minimising dilution. For me, it’s not % holdings that matter, it’s growing value over time in an upwards direction that is key.

– In terms of revenue generation, how are things going?

Very well. We are currently focussed on selling to law firms but have in parallel also been acquiring non-law firm customers such as accounting firms and in-house legal and finance teams at corporates (often via introductions from our law firm customers). We now have 3/5 Magic Circle law firms as customers, which I believe demonstrates the quality of our offering both in terms of product and service. Quality demands quality. In parallel, we are also increasingly winning business on the other side of the Atlantic having won several Am Law 100 law firms with various exciting opportunities progressing nicely through our sales funnel. The macro-economic climate is obviously less than sunny currently but we have a product that facilitates legal work in upward and downward market contexts.

– How many staff do you have / and will reach after spending this capital?

We currently have just under 30 people in the team. Our plan with this funding is to make a small number of strategic hires in particular in operations, marketing and product & engineering – but we will keep the team broadly the size it is now. This will allow us to focus on growing our revenue into our cost base, tightening efficiency (which investors want to see in this climate), preparing for a Series A fundraise next year which will provide capital to scale the business.

– What is your growth plan for the next few years?

We are broadly targeting doubling our revenue year-on-year over the next 3 years as we move to Series A then Series B stages of our trajectory. The Series A raise will allow us to scale the team – building out our capabilities and allowing us to expand our go-to-market activities beyond law firms and systematically focus on other types of organisations in the transaction ecosystem (accounting firms, PE/VC funds, asset managers are in our near-term sights). Linking into this is our belief that the collaboration functionality in our product can enable a product-led growth motion where the software can start selling itself when used by a variety of stakeholders on deals. We are already seeing signs of this with the organic word-of-mouth referrals we are getting as mentioned above. Onwards & upwards!

Thanks Tim, and good luck with the growth plans!