New York-based smart contract pioneer, OpenLaw, is exploring the use of stablecoins in an effort to remove the unpredictability of crypto values when conducting transactions through a blockchain. In this case, the company, which is supported by ConsenSys, is looking at the stable coin ‘Dai’.

A stablecoin is designed to keep its value, in order to make blockhain transactions reliable enough for businesses to trust. OpenLaw has also already partnered with ChainLink, a blockchain company that has pioneered oracles that help people to use fiat currencies to transact via a blockchain system.

The company behind Dai, Maker, says that ‘with Dai, anyone, anywhere has the freedom to choose a money they can place their confidence in. A money that maintains its purchasing power. [And] every Dai is backed in excess by collateral at all times, so you never have to worry about its value moving up or down‘.

What this means is that if you have, for example a smart contract in US dollars, and you need to transact via a blockchain – and hence are likely to use a crypto currency as an intermediary currency before it’s converted out again into fiat currency – then the volatility of the ‘carrier’ crypto in the middle of the transaction could be an issue.

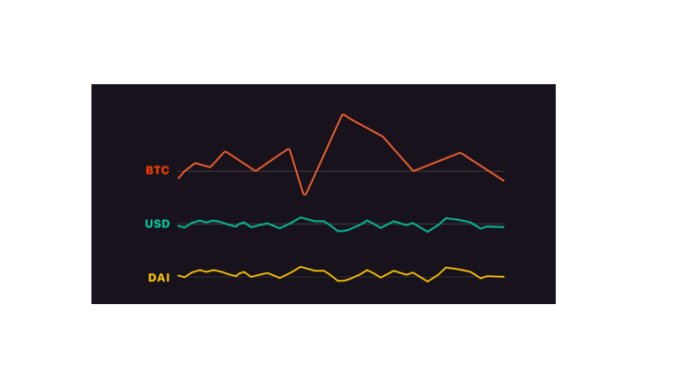

As everyone has seen, crypto values can surge or drop wildly across a network of digital exchanges around the world. Take the example of Ether, the Ethereum-based currency – see below.

OpenLaw co-founder, Aaron Wright, told Artificial Lawyer: ‘We can denominate a smart contract transaction in US$, but then settle it in Dai, with the final output then in US$. In effect the Dai coin is in the middle.’

It’s an exciting move, as it takes the market closer to being able to transact via a blockchain without the user ever having to think about the underlying tech – which is how it should be.

We don’t ponder the use of wireless networks when we buy something on Amazon with a mobile phone. We just do it. If smart contracts are to work seamlessly then people need to be able to just click and transact in $ or £, and not ever even have to think for a moment about the price of Ether or any other crypto coin that may be part of the transaction functioning via a blockchain.

To explain the thinking around the use of stable coins in more detail, here are Wright’s and the OpenLaw team’s thoughts below.

—

Making Smart Contracts Stable and Legally Sound

In an environment where stability is hard to come by and prices are variable, parties using OpenLaw can reduce risks by wrapping complex commercial legal agreements around smart contracts transmitting stablecoins such as MakerDAO’s Dai.

Over the past two years we’ve witnessed a blossoming token economy. Tokens are being used to represent software licensing rights (as in the case of ERC-20 consumer/utility tokens), tangible assets like real estate, and intangible assets such as intellectual property rights.

A key cornerstone of the emerging $200+ billion token economy are stablecoins — or digital assets managed via a blockchain aiming to reduce price volatility of native blockchain-based tokens like bitcoin or ether. Some stablecoins are pegged to centrally maintained reserves of “fiat” currencies, or government-backed legal tender, like the U.S. dollar. Other stablecoins, such as Maker’s Dai token, rely on over collateralization to guard against changes in the price of ether.

Stablecoins hold out the hope of making blockchain-based commerce transactions more accessible to parties that may be reluctant to expose themselves to token-based price volatility in commercial transactions. They may serve as the missing link to help more mainstream enterprises and other parties begin to rely on blockchains — not just for proofs of concepts — but real world use cases.

The need for stablecoins is particularly true for blockchain-based loan transactions where parties to the transaction, whether borrower or lender, may suffer significant losses due to token volatility relative to stable fiat currencies, like the U.S. dollar.

That why our team thought it would be interesting to explore how some of our prior demonstrations may benefit from the fiat-to-crypto price stability offered by stablecoins. In prior examples, such as our sale of land agreement, employee offer letter, loan agreement, or our intellectual propertytokenization demonstrations, the OpenLaw team denominated the transactions in ether. Understandably, commercial participants are reluctant to use ether for transaction, due to the price volatility risks.

MakerDAO’S Dai helps solve this problem. Below we explore how our prior loan demonstrationcould be refactored to transact in MakerDAO’s Dai instead of the native, and somewhat volatile, currency of the Ethereum blockchain — ether. Instead of loaning ether, this modification to the traditional legal prose, as well as, the underlying smart contract, now supports the Dai stablecoin.

Every facet of the lending agreement from the initial funding of the loan by the lender to the borrower’s repayment and interest obligations, can now be based on the Dai stablecoin. This gives parties comfort as it substantially reduces the currency risk that borrower or lender may be exposed to if they used a less stable cryptocurrency, such as Ether or Bitcoin. By using OpenLaw, along with Dai, we mirror the components of a traditional, off-chain loan agreement between a lender and borrower, while reaping the benefits and efficiencies of blockchain technology.

By integration with Dai, or other stablecoins, we believe adoption to blockchain technology in the commercial context can be actualized by the OpenLaw protocol. Parties to a transaction will feel more comfortable engaging blockchain-based commercial transactions, while managing their risk with a legal agreement using OpenLaw.

Stay tuned! As we develop our protocol, we’ll be releasing smart contract components and other plugins that will enable you to denominate any agreement in a stablecoin, like Dai.

For those interested in learning more, check out our main site and documentation for detailed reference guides and an overview. And, please don’t hesitate to reach out to us at: hello@openlaw.io

— The OpenLaw Team

2 Trackbacks / Pingbacks

Comments are closed.