Last week, smart contract consortium, the Accord Project, held its first ever major conference, marking a key moment in the development of the 200-member global group and a declaration that the technology is coming of age.

Artificial Lawyer attended (and its founder MC-ed) the Forum event, which had none other than the City of London Corporation (CLC) as its key sponsor. There were many great speakers – too many to cover here – but the following were some of the moments that caught the attention of AL.

—

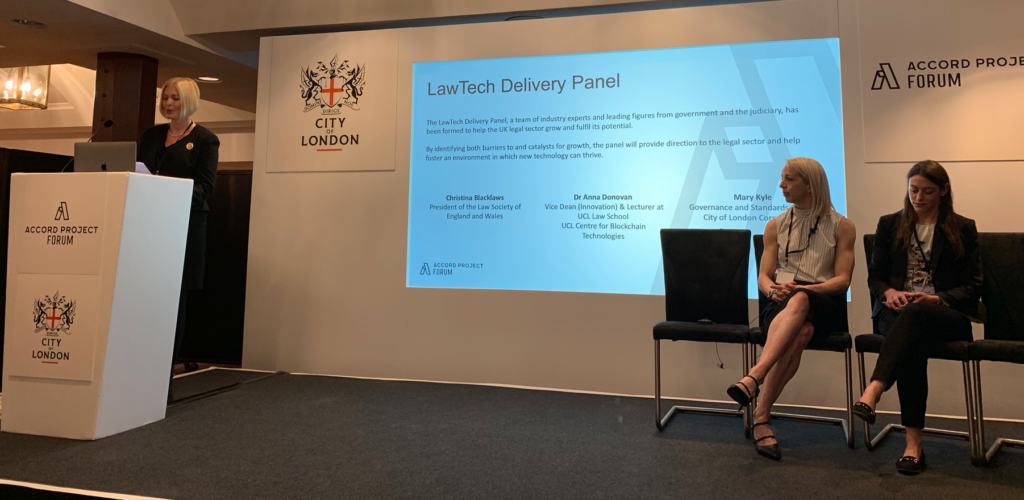

Lord Keen, spokesperson for the Ministry of Justice (MoJ) in the House of Lords, kicked off proceedings, then joined a panel featuring Christina Blacklaws, President of the Law Society; Dr Anna Donovan, Vice Dean (Innovation) for the Faculty of Laws, UCL; and Mary Kyle of the CLC.

Kyle talked about how the CLC was 100% behind the initiative of the MoJ and Law Society to drive legal tech innovation and adoption, including in relation to smart contracts. And it was good to see the body that represents the financial capital of the UK join the growing list of supporters of what we can call ‘Legal Tech UK PLC‘.

Lord Keen made the key point that regulation – when and where it was needed for something like smart contracts – would ‘inspire confidence’. Hence the soon to conclude consultation by the LawTech Delivery Panel on DLT, smart contracts and crypto (see story), would help clarify what – if anything – needed to change to provide that confidence for the market.

Lord Keeen also fielded a series of questions from the audience, including whether the Government would be providing the world with a portal for ‘machine readable legislation’, to which he responded that it was on the cards, but not right now.

The Law Society’s Blacklaws gave some more information on the recently published report about the need for a better governance structure for algorithmic and AI systems in the criminal justice sector (see story).

She also picked up the point for the need for more case law data to be made public and that it should be easy to access. ‘There is a lack of accessible data on judicial decisions and we need to look at that,’ Blacklaws added.

And then onto the rest of the day we went.

–

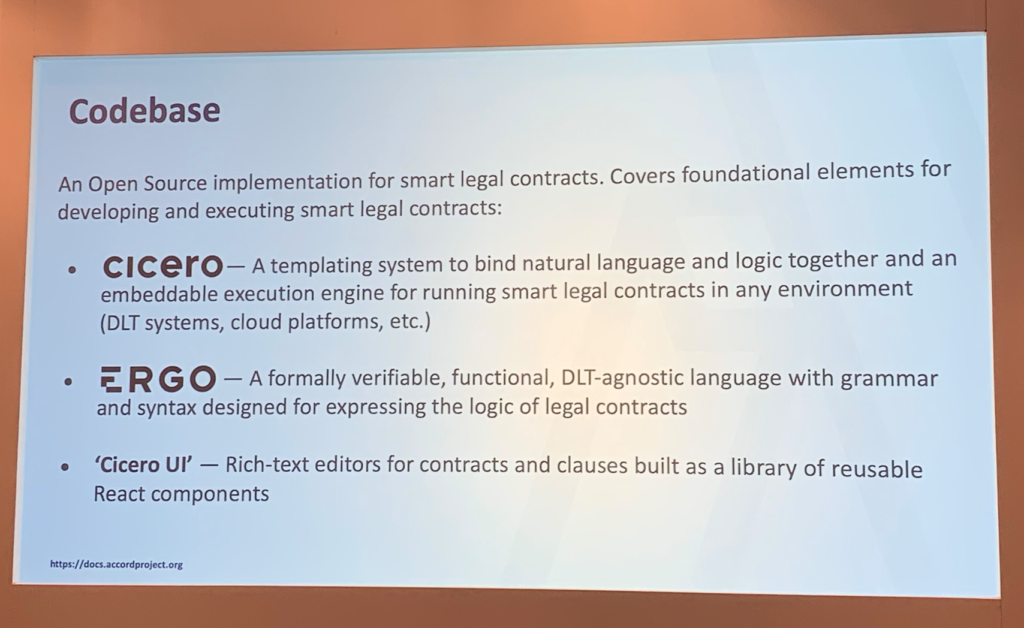

Dan Selman, CTO of Clause – the smart contract startup and driving force behind Accord – then gave a talk about where we are now with smart contracts.

‘Those contracts need to be connected to the sources of data and we can’t leave [the] legal [world] disconnected,’ he added.

I.e. we live in a world where we are used to much of our lives being connected digitally in a useful way, yet here was legal, of massive importance, where the central data repository that this industry runs upon, ‘contracts’, still stuck in a closed-off, analogue environment. That in turn slows things down and adds to costs.

Selman added that although there was some cynicism about the benefits of blockchain, that the ‘traceability’ aspect provided by the technology was of clear value.

He announced that Accord was moving under the wing of the open source group, the Linux Foundation, (see earlier story), and said: ‘They are a world class steward of open source projects, so we are really excited to join them.’

He added that this was important in several ways, as they needed a ‘self sufficient funding model for Accord’.

This is because Accord provides its smart contract software for free under licence. While Clause has now moved to a commercial footing. Therefore Accord’s good work needed support.

And there was the good news that DocuSign had also joined the Accord Project (see info) – which was followed by a great demo by Heather Petersen, Senior Director, Trust Strategy and Marketing, DocuSign.

She talked about the need to break down digital silos and stated that ‘legal enforceability is better if we combine natural language and coded parts’ of a smart contract.

I.e. from DocuSign’s point of view, the best outcome was a smart contract with ‘traditional’ text and coded elements that connected to the outside world and could trigger actions upon meeting certain conditions.

—

The simple version goes like this: in an environment where there are multiple parties all around the world involved in a food supply chain, from a collective of farmers on the other side of the world, to all the middlemen, shippers, re-sellers, storage facilities and more, until that food finally enters your kitchen, then you can’t easily or efficiently operate off one single database managed by one administrator – it just was not practical. Nor could you be sure someone in that complex mix of parties, each with their own interests to look after, had not messed things up and let bad food through the system. And if one party did how would you even trace them? Each party had their own data base in a silo, (or had no functional data base at all).

Cuomo noted that after the e.coli scare in the US in relation to spinach it took two weeks to trace where the bad food had originated, as there was no system in place that could quickly track data across the complexity of the global food supply chain.

So, a number of large food retailers/makers have now got behind the Food Trust Network, including Dole, Walmart, Unilever, Nestlé and Carrefour, to work with IBM on a blockchain supply chain data solution.

‘You can now see where a packet of food came from, you see everything, all the way back to the farm. This is real and running now,’ he stressed.

Any road, this looks highly sensible. And into this mix smart contracts can play a part, from releasing payments, to using IoT devices to track position of goods and even temperature and humidity in the food crates, which may indicate if it has been spoiled or not.

—

Then a panel on capital markets. One speaker, Sue McLean, a partner at Baker McKenzie, made several notable points. These included:

- ‘There are key benefits in just sorting out all of your data via smart contracts, just knowing what is happening and breaking down silos in organisations.’

- ‘Why are people still writing up NDAs? Why do that?’

- ‘Many of these projects won’t work, but they will make people think. Failure is not failure, it’s a learning.’

- ‘You need courage and endurance to keep it going.’

And on the last point McLean is 100% right. Trying to change the world, even in the very niche area of commercial contracting, is not for the faint hearted. Setbacks will come, but they are an opportunity to learn and improve. The fundamental challenge is not giving up, as most of human history has shown over the last few thousands years.

—

We then had talks by the likes of ISDA, R3 and others, but the message was generally the same: moving to the digitisation of strands of legal meaning, creating a means for this data to feed into contract creation, and after that to improve insight into legal data via analysis.

The point was also made that markets often move in seven year cycles. Therefore, if we accept that….then taking 2015/2016 as an approximate start date for the new wave of smart legal contract technology, then perhaps we will have to wait until 2022 for significant uptake. Can we wait three more years…? I guess we can.

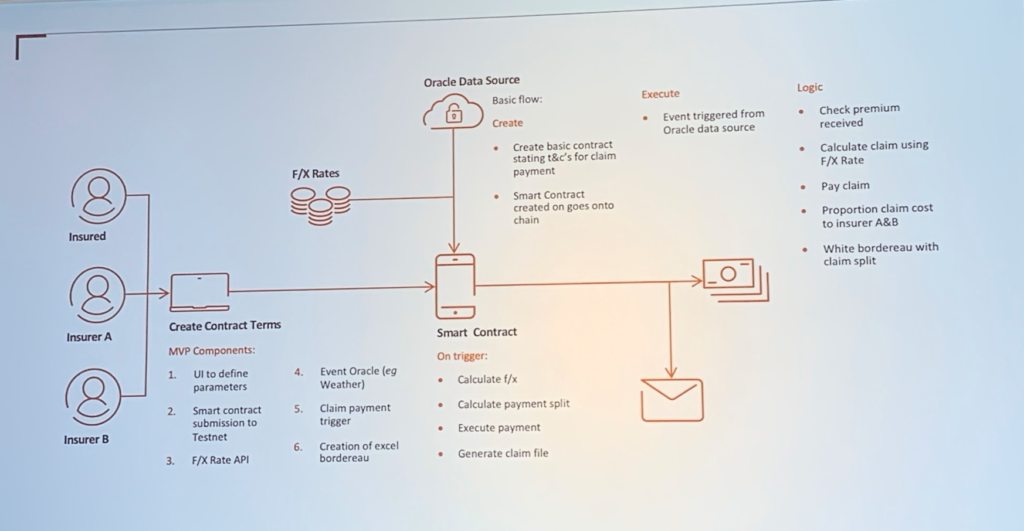

Then we had a great demo by global law firm, Clyde & Co, with partner Lee Bacon, who is also part of the firm’s Clyde Code group, walking us through their first ever smart contract product – a parametric insurance smart contract that responds to changes in the weather and could be used, for example, by energy companies to help hedge their exposure to changes in the weather.

Before going into the heart of this, Bacon said something that really resonated: ‘People don’t want contracts, they want a transaction – the contract is there to give confidence.’

He also pointed out that it now costs thousands of dollars to manage each and every contract that a company has – and that was clearly inefficient.

Indeed. Contracts are a means to an end – making sure something happens as agreed. And at present they are a disconnected and highly inefficient means to that end.

We don’t have space to go into every detail, but as you can see from the diagram, there are several steps, moving from the contracting parties agreeing the terms, to those terms inserted into the smart contract, that contract is then hooked up to multiple weather data providers, and then the contract responds to the inputs.

Bacon noted that English law already upheld parametric contracts, i.e. contracts that were based on paying out based on certain conditions, rather than the loss of something.

Or: ‘It’s a policy versus an event happening that may affect your business, so you insure versus that loss.’

Bacon gave the example of a solar energy plant that could not guarantee the impact of future weather on its business, so hedged future outcomes with such a contract based on weather data.

He noted that the contract draws in data from multiple weather data sources in case any particular one goes out of action. There are also provisions to respond to special events, such as named storms arriving. All of this is programmed into the contract which responds to live data.

OK, all very nice….but why do this, you may ask?

One reason is that it can take insurance companies a long time to sift through all the data after the fact and then decide what should be paid out to a company that was operating in a particular location. With the smart contract there are no quibbles, the data is there, the agreement executes the terms – which can include direct payments, and everything is recorded, everything is transparent with an audit trail.

Insurance companies are rather excited by this technology as well. Why? Because one of the biggest costs for insurance companies is back office teams whose job is to pore over paper contracts and decide if they should pay and then who to pay. In this example, everything is one integrated whole.

The discursive bit is between the lawyers and parties at the start when the terms of the contract are made. After that….well, if you wish it to it can run itself.

Bacon added that the contract also produces a load of real time data that is shown in graphs. This ‘is an underwriters’ dream’ Bacon added. And one can imagine if your job is to get a handle on data, then something like this would really be a useful step.

—

Oscar Vickerman of Sweetbridge then chaired a business integrity panel. The one comment from this panel that really stuck in the mind was that the 2008 crash, brought on by mortgage contracts and their secondary credit default contracts that no-one knew the full extent of – and which we are still living with today in the shape of government austerity – could have been avoided in a world of contract data transparency.

I.e. if all those loans and default insurance policies had been in the shape of smart contracts and all of their potential payout data had been visible in real time to banks, insurance companies and regulators, then 2008 may never have happened…..at least if bodies such as the SEC had acted in time (which is of course not guaranteed, unfortunately, given past performance).

But, at least tidying up the mess would have been a lot faster and perhaps saved some banks and institutions from collapsing as everyone could have seen their real exposure hour by hour, rather than guessing at it and in turn destroying confidence in those banks as no one knew what the real underlying contractual data was.

So, that was something to think about…..smart contracts could have prevented the collapse of Lehman Brothers and all that came with it – or at least that’s AL’s take on what was said.

—

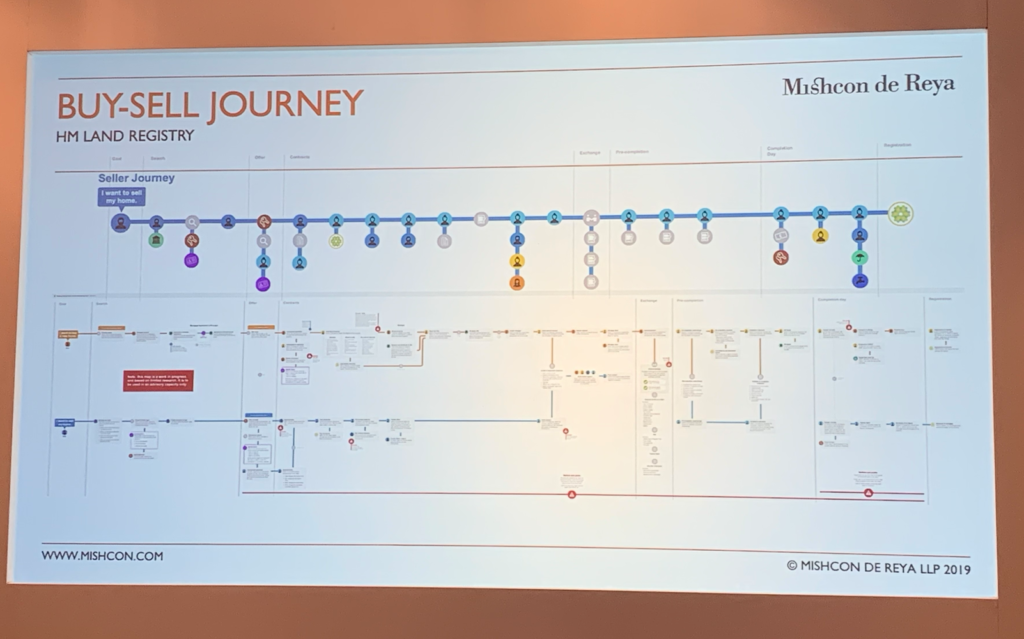

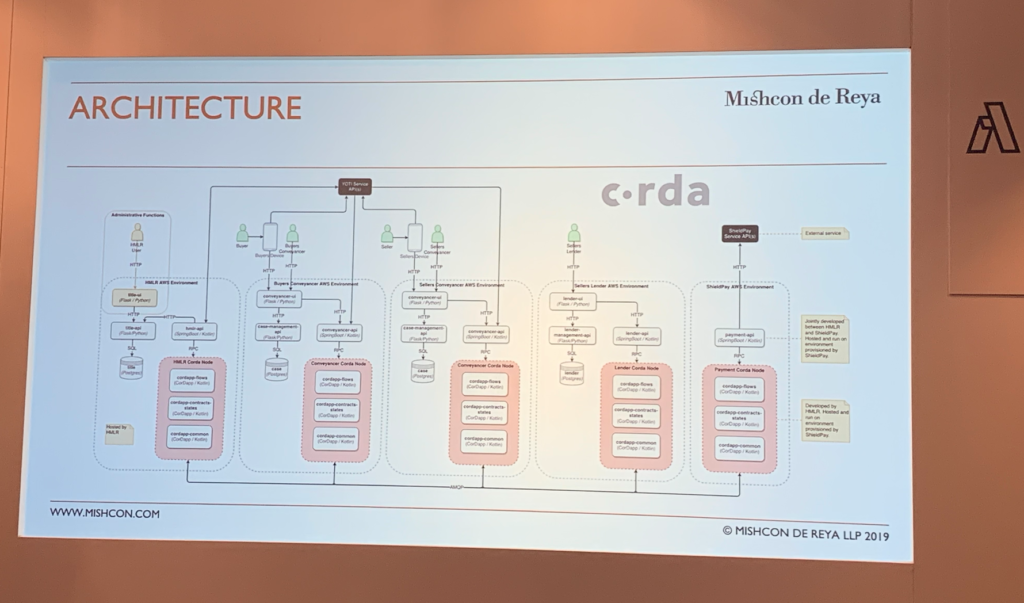

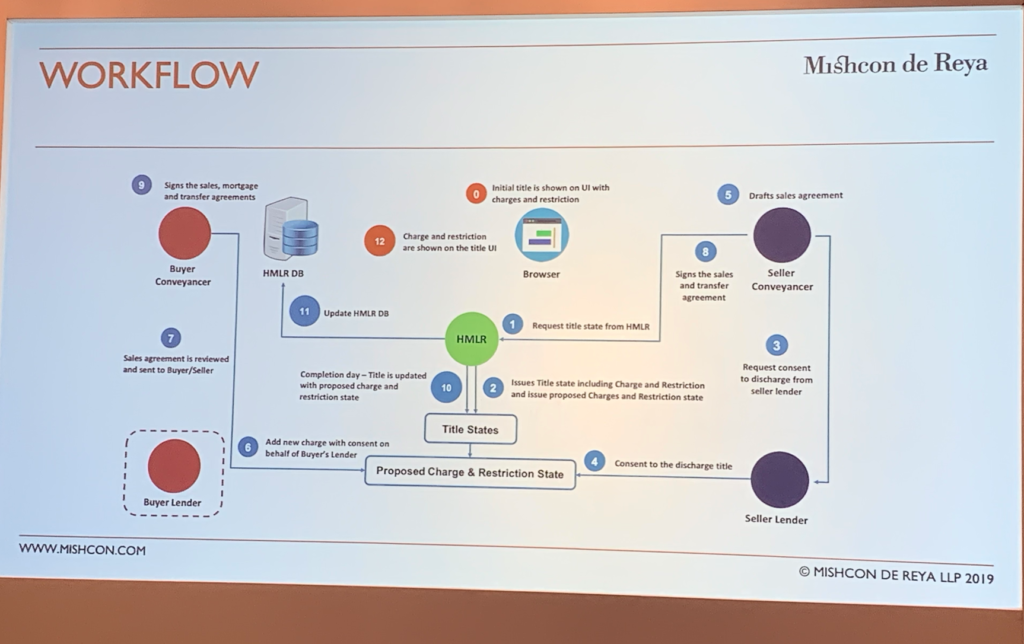

And finally, Mishcon de Reya‘s Niall Roche and Alistair Moore gave a walkthrough of their work on simplifying English conveyancing with R3….and wow…..does it need to be made more simple (see the process maps below).

There really isn’t room here, or perhaps anywhere else on the planet, to go into the full details of how people buy and sell property in the UK – but suffice it to say here it’s a bowl of legal and contractual spaghetti with multiple parties’ forks swirling around within it in a gloriously inefficient and messy process.

As can be seen below, even when Mishcon took a relatively small part of the process apart it remained fiendishly complex.

It just shows some of the challenges the smart contract world is up against. Ironically, something that sounds far more complex than selling an asset such as a building is a parametric insurance policy for a solar power plant that is impacted by future weather…..and yet, (at least based on what was seen), insurance looks to be ‘relatively simpler’ than conveyancing, and by a factor of 10.

And that’s a good note to end on.

The reality is that smart contracts look to be excellent technology for certain use cases and can be utilised in a clear and logical way that really helps add efficiency, saves money and improves accountability – not to mention provides far better data insights.

And then…there are other use cases where the sheer complexity suggests there is going to be a lot of more hard work to come. But, Rome wasn’t built in a day and from hearing from those involved there is easily enough brains and enthusiasm in play to make it all happen. So, Artificial Lawyer left the conference feeling more certain than ever before that smart contract tech is going to work, it’s just not going to be plain sailing for every use case. And some areas of the law will likely adopt smart contracts faster than others, take insurance for example.

—

Conclusion: having an all day conference just on smart contracts, backed by the CLC, and with speakers from major law firms, really made one appreciate that the technology has come a long way in a short time.

There may well be a few more years before we see widespread take-up – but as Dan Selman said at the start of the conference, ‘this is the end of the beginning’. Well done to all involved. It’s quite an achievement!

If you’d like to get involved in the Accord Project, then you can join here.

1 Trackback / Pingback

Comments are closed.