Legal AI doc analysis company, Luminance, has filed its accounts for 2019, showing that the fast growing company saw revenues last year of £2.356m, ($3.12m) – but also booked an operating loss of £5m ($6.62m). The figures paint a picture of successful global expansion, but also a business model that is rapidly burning through funding and generating only a modest average income per client.

For example, Luminance estimates it had around 200 clients by the end of 2019. Based on that number, this gives an average income per client of around £11,700 ($15,500). For some types of software company that would sound like a great figure, but the business model for doc analysis and review is usually based around firms and corporates making extensive use of the NLP platform, e.g. for M&A due diligence projects, resulting in substantial fees for the AI doc analysis vendor, rather than just relying on a single, annual licence payment.

I.e. if your business model is all about clients’ usage of the platform on deal after deal, and project after project, then an average income per client of £11,700 would appear to indicate low average usage across the client group.

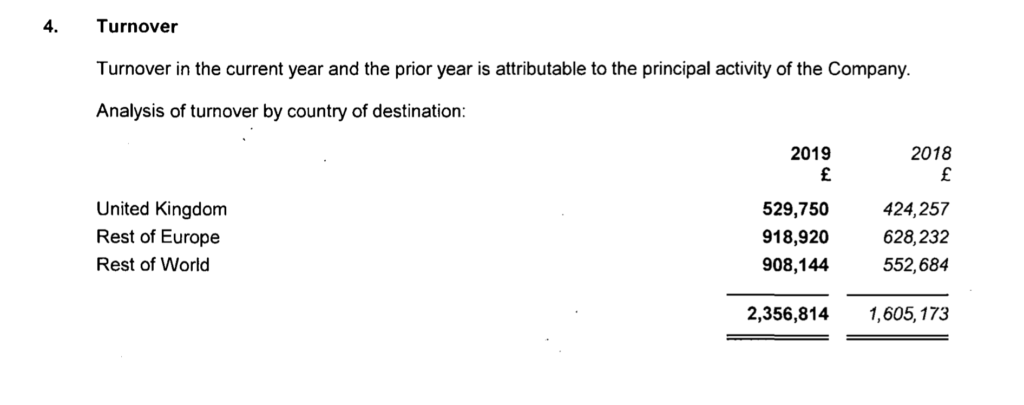

That said, there are several positives. Revenues rose from £1.6m to £2.356m, which is an additional £756,000 in earnings on 2018, or an increase of 47% – a growth rate that any company would be glad to see.

And as mentioned, they had grown to around 200 clients by the end of 2019 – which is very rapid expansion for a legal AI doc review company. The company’s initial formation began back in 2015, but it really launched in the autumn of 2016. So this represents the output of 3 and 1/4 years.

Of course, some in the market have questioned how they are counting these clients, i.e. including clients at a proof of concept stage, or those fully using the software on an annual basis.

When asked about the figures, Luminance was bullish, and told Artificial Lawyer: ‘It is very common for early-stage high-growth businesses like Luminance to be loss-making in order to grow. Like most start-ups, we invest heavily in R&D, sales and marketing, hiring across the business and office expansion in order to meet global customer demand and strengthen our foothold in the market. The company is revenue-generating and has seen a 40% increase in customers in 2020.’

They added that the company now has around 280 clients, as of November 2020, and highlighted how Luminance has also moved into the litigation doc analysis space – a move that overlapped with the departure of previous CEO, Emily Foges, to Deloitte, and with US-based Jason Brennan taking on the top role.

Artificial Lawyer also asked several legal tech experts what they thought. Views ranged from ‘it’s normal for companies at this stage and with external investment to rapidly burn through their cash’, to some surprise at how low the average revenue per client is.

One legal tech expert noted that if a software company was serving a market of many thousands of potential clients, then low revenue per client was not a big deal, but in a market segment where you’re looking for heavy users of the product, often on an event-driven basis, e.g. M&A deals, major property transactions, or large-scale compliance reviews, then the actual market is more likely in the hundreds of clients globally, at least among law firms.

That then puts the focus on not necessarily having tonnes of clients, but having clients that really use the software at scale.

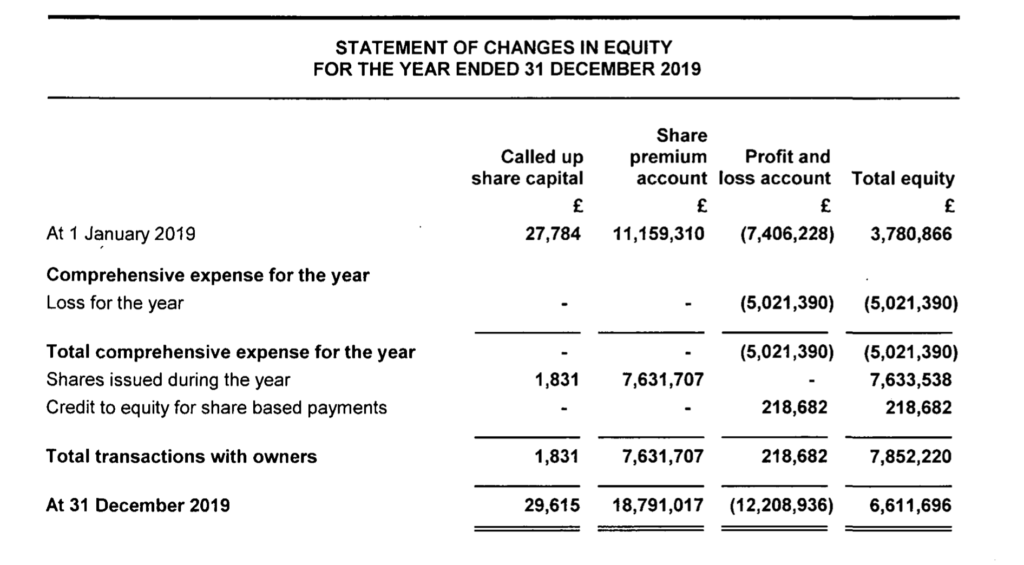

Another aspect is funding. The last major input of capital appears to have been in February 2019, which was for $10m, giving the company $23m in total funding so far, or, around £17m at today’s exchange rate. Clearly several million pounds of that funding remains to be spent. But, if losses are potentially around £5m in 2020 as well (which we don’t know yet – but is a reasonable guess based on 2019), then new investment will be essential.

The company told this site: ‘We expect to complete additional investment in the early part of 2021.’

After what has no doubt been a somewhat bumpy 2020, given how the pandemic has impacted many M&A deals, 2021 will be a key year for the company, especially on the point about turning those many clients into far greater users of the software.

Overall, there are both positives and negatives to take away from these figures. But, either way, Luminance is still in the game and is still aiming at continued rapid growth.

These are crazy poor results given all the PR bluster from Luminance. It is no help at all for the wider legal tech industry that a supposed poster child like this can have such low income and have lost so much $

$3.1m in revenue is peanuts for 200 clients, if that were Luminance’s revenues for 20 clients their performance wouldn’t look so poor. I suppose the issue is that usage based pricing models don’t work, particularly when law firms aren’t using the product. Subscription pricing is the only way forward. Look at Ayfie’s 2019 revenues of $5.1m of which 83% are recurring according to their published financial statements.