Legal AI company, Ayfie, has closed its key German base in Munich, losing the company’s new CEO in the process, as part of a radical cost cutting drive to improve profitability of the now publicly-listed company. The unexpected move will see around 10 job losses.

The moves come as something of a surprise, given that the now outgoing CEO, Johannes Stiehler, who is based in Munich and had previously been the company’s well-known CTO, had only just taken on the top job in April this year. His elevation had in turn followed another shakeup of the company, that saw long-term CEO, Erik Baklid, leave the leadership role.

The new CEO of the company – its third in a year – will be its current CFO, Siw Ødegaard, who will run the company from its long-term base in Norway. And in fact, the re-focus on Norway is central to this story.

When asked why the sudden decision to close the German office – which had been a key part of the international company that has clients in the US and UK – Ødegaard told Artificial Lawyer: ‘Ayfie has invested significant amounts in research and development (R&D) since 2016, both in core technology and in products. The German office has been a development hub, whereas our business has been building up in the Nordics, the UK and the US.

‘Now with our proven Corporate Insights Solutions and solid customer base, Ayfie is entering into a new stage with more focus on markets and sales. We are in the process of building strong sales and service organisations in our main markets and have decided to have product development closer to the core, in order to better serve our customers and to streamline operations. Going forward all development, including R&D, will be run from Oslo, Norway with dedicated teams in Norway and Poland.’

Or, as one source close to the company explained to this site: ‘Munich is an expensive place to have a dev team. The company in effect had two dev teams, one in Norway and one in Germany.’

The source added: ‘Johannes did nothing wrong. But he was caught between a rock and a hard place.’ I.e. he was the CEO, but he was in a base that was costing too much.

After contacting Stiehler, the outgoing CEO told Artificial Lawyer: ‘I can no longer officially comment on behalf of Ayfie Group or speculate about the intentions of the new leadership. I can only say this: when I took over the role of CEO, I did so to strengthen Ayfie’s focus in the legal market and further expand its reach in the US and the UK because I believe that Ayfie’s products can have real long-term success there.

‘I made it clear from the start that I was not interested in running a Norway-focussed enterprise search company.’

So, what’s next? Will Ayfie keep its public listing? And will it maintain Stiehler’s strategic goal of increasing the focus on the legal sector, rather than keeping a more multi-sector approach as it had before?

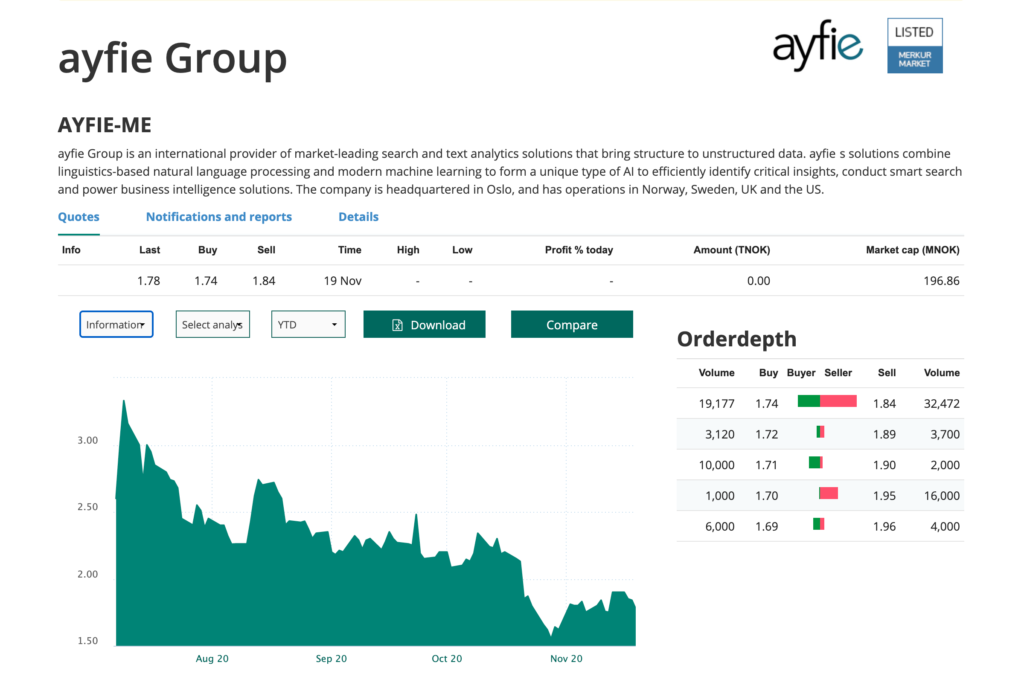

First, the Merkur Market public listing in Norway, which took place recently with apparently strong support from Stiehler. Ødegaard told this site: ‘Ayfie was listed on the Oslo Stock Exchange Merkur Market in July 2020 and the company’s ambition is to create long-term shareholder value as a listed company.

‘NOK 105 million ($11.7m) was raised in private placements prior to the listing, and the company has solid equity and a cash balance to be invested in further growth, both organic and inorganic.’

And with regard to ‘inorganic’, the company has also recently bought enterprise search company, Haive, which suggests more deals may be on the way.

In regard to the increasing focus on legal, that seems to have changed a bit. Legal will remain a key part of the company, but it looks like the plan to really re-focus there is not happening now, and a more multi-sector approach will resume as had been the case under Baklid’s leadership.

Ødegaard was also asked about the Merkur Market statement that the company would ‘return to profit in Q1 2021’, i.e. it’s been making a loss recently.

She noted that as the company ramps up sales of the software it’s been developing ‘the company will become profitable’.

And, on the financial point, with all these changes over the last year or so, how is the company doing in terms of sales? She replied that the revenue for the last financial year was NOK 46 million, or $5.1m.

So, what does all of this mean? From the outside looking in it would appear to be very much about what happens when a company lists on a public market and its share value suddenly becomes a point of significant management focus. Cutting a 10-person office – where their new CEO was based – seems to be such a significant move that it suggests a strategic push to improve the balance sheet nearly above all else.

Better balance sheets mean better share prices for a listed company. They also help to prepare companies in general for a future sale – although there is as yet no indication that this is the strategy of Ayfie.

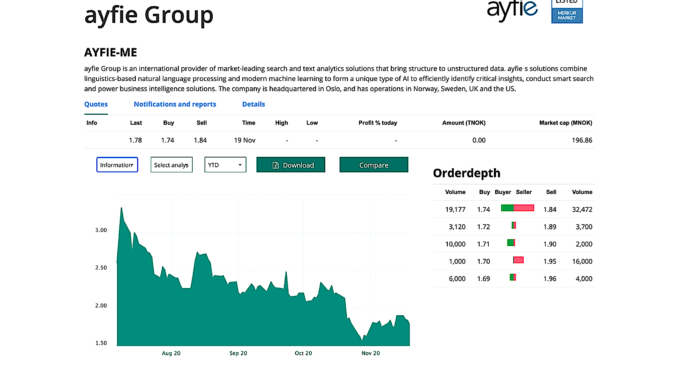

As you can see from the share data above, Ayfie’s share price has steadily dropped since it was listed in July this year. However, a few days ago the price started to pick up again – possibly driven by the changes at the company.

As to what happens next, one can imagine that in 2021 there no doubt will be a big sales push, especially around enterprise search, which the company is hoping will set things on the right track.

(Note: One benefit of legal tech companies listing is that we will soon be able to see what the market really thinks, as the share price will indicate investor sentiment on how the company has performed.)

Looks more like they are struggling and panicking. If the software was so successful, they wouldn’t be hacking off the former CTO / now CEO and dev team just to balance books.

This company seems to be undervalued? With a revenue of $5.1, a recent substantial private placement and quote: ‘return to profit in Q1 2021, they seem to be in a good state? Will be interesting to see what is announced from this company going forward.

Three CEOs. I’ve worked in start-ups where the CEO’s changed every 18 months. Key to their success will be strong customer focus and product, not focusing on the stock price. These guys work with large corporates like Skanska and Siemens, will they be able to get into their in-house legal teams to drive growth outside law firms?