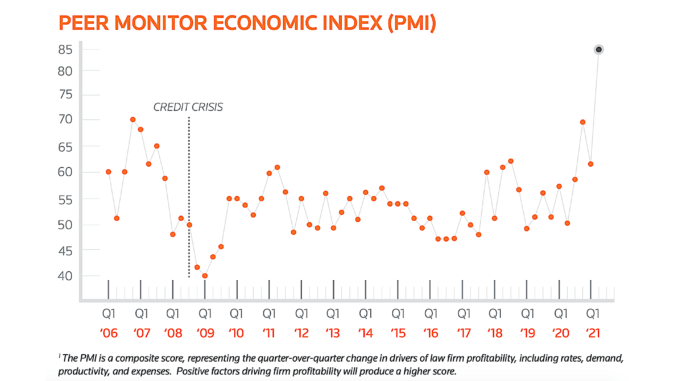

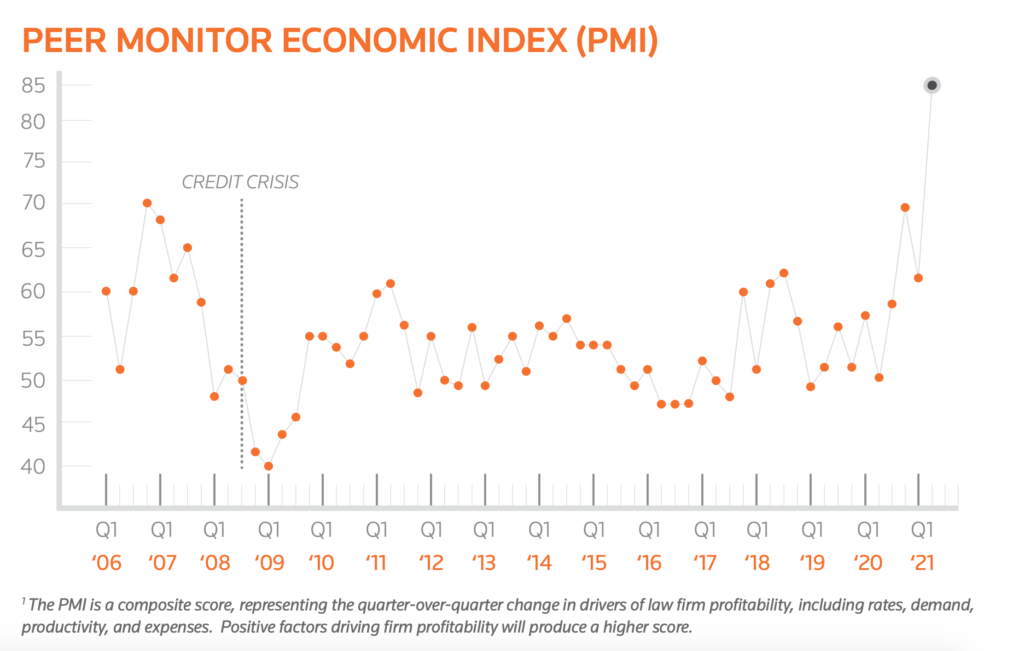

The latest Peer Monitor Index report from Thomson Reuters, which tracks the performance of large law firms in the US, shows that Big Law is booming, with its profit-focused Index reaching an all-time high. Meanwhile, spending on tech and knowledge management (KM) has also increased.

This report shows that tech spending increased by 3.3% compared to last year, and that KM spending increased by 5.1%. These are not huge increases, but they are certainly healthy and bode well for legal tech vendors – and the law firms.

Better KM systems will have supported firms in deal work and litigation matters. And a variety of legal tech tools will have allowed associates in particular to be more efficient and put more of their billable time into higher value matters for clients. Tech will also have enabled firms to take on more matters in total and allowed those deals to be managed more easily. In short, the ‘engine’ of the law firm is operating better, allowing more to happen and to generate more value.

For a long time, tech spending has been framed as ‘an investment’ by the legal sector, that you hope you will eventually get some ROI from. I.e. it’s something of an educated gamble, rather than something that any law firm partner should actively want to be spending money on as it will certainly be of help in increasing law firm profits.

Now, one chart doesn’t make a trend, but it’s good to see these figures going up in a time of great turmoil for the market. Whether the uptick in spending, albeit modest, continues remains to be seen and the next Quarterly report will make interesting reading in that respect.

Moreover, it seems unlikely that we can ascribe all of these increases to video coms systems, as firms moved to working from home in the Spring of 2020, and this report covers Q2 of 2021. So, it suggests increased spending is going elsewhere. And, the KM spending is clearly not related just to a rise home-working needs.

In terms of the overall picture for Big Law, it’s worth mentioning that law firm profits respond to small changes in their overall cost base. A healthy uptick in work, plus a drop – in this case 4% – in overhead costs compared to the same time last year, can result in profits per equity partner soaring.

Plus, it’s worth mentioning that law firm spending on marketing and BD dropped by an incredible 44.6% compared to last year. And that will have saved firms a penny or two, to put it mildly.

But, what did Thomson Reuters make of the results? They said: ‘Demand for legal services is now higher than it was two years ago, prior to the pandemic. And measures of firm profitability are significantly higher.

‘The dramatic rise in second-quarter demand was primarily driven by strength in M&A and other corporate work. Several other practice areas, including real estate and employment, also saw demand grow to above pre-pandemic levels. A partial recovery in litigation also contributed. While rate growth slowed slightly from recent quarters, it was still a solid 3.4% this quarter.

‘Meanwhile, overhead costs such as office expenses, continued to decline, even as many firms prepare for a return to the office. Technology and knowledge management, including library services, expenses were notable exceptions, rising in the second quarter as firms continued investing in resources to support lawyers’ workflow – both remote and in-office.’

And to conclude, Mike Abbott, vice president, Market Insights and Thought Leadership, Thomson Reuters, said: ‘Firms and lawyers are leveraging strategic and operational flexibility, as well as innovative technologies, to meet the rapidly changing needs of their clients and position their firms for continued success through conditions that remain both fluid and challenging.’

You can get the full report here.

1 Trackback / Pingback

Comments are closed.