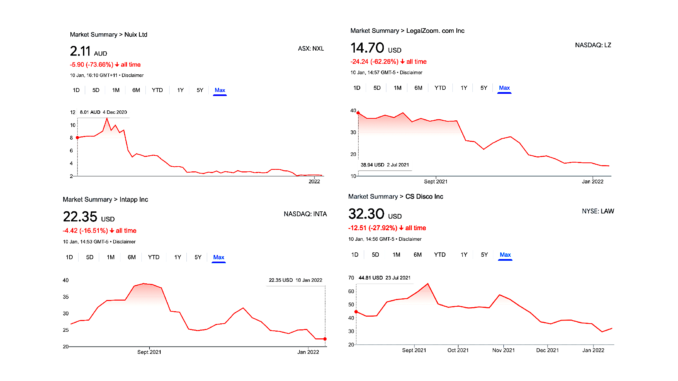

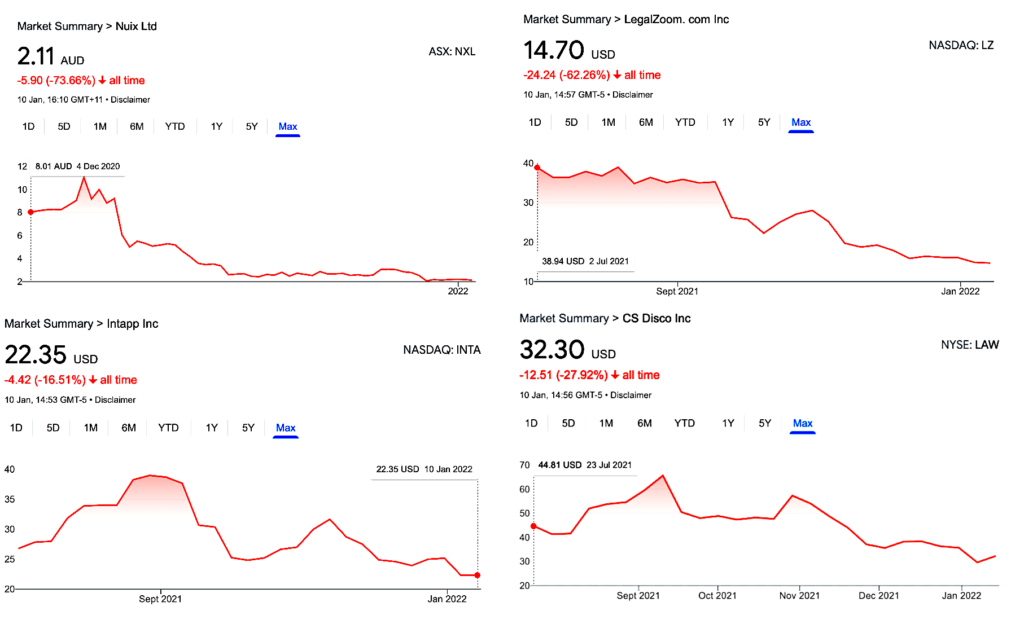

The share prices of four legal tech companies that undertook IPOs are now all below their debut level – some extremely below: LegalZoom’s share price is down by 62% already, and Nuix shares are down by 73.6%.

Meanwhile Intapp is down by 16.5% and DISCO is down by nearly 28%. And even KL Discovery, which is planning a full IPO, but started selling its shares privately on the OTC market in 2020, has seen its share price drop by 60%.

All in all, if you have invested in a spread of legal tech stocks then you are looking at considerable losses right now – unless you can hold your nerve. And of course, stocks do bounce back. But, the key point here is that the hype around legal tech IPOs has taken a battering from good old-fashioned investor scrutiny. I.e. investors don’t see the massive growth some might have predicted, because if they did those prices would be rising.

Check out the tables below, via Google data, for the share prices as of yesterday (Jan 10).

So, what does this all mean? Let’s unpick this a bit. First, Nuix has been facing some serious issues after what the Sydney Morning Herald called a ‘damaging disclosure and governance scandal’. Meanwhile, Legal Zoom has missed analysts’ expectations on its financial performance.

The other price drops are less obvious in terms of cause. Given all the excitement over Intapp and DISCO going to the public markets one would have thought that sentiment and momentum alone would still be carrying the prices upwards. With stories about ‘hyper growth’ for legal tech and the like circulating, one might believe their shares would be soaring. But, not so.

Now, it’s true that many US tech stocks have taken a hit the last couple of months, but, even so these two legal tech companies, fresh from their debuts should be doing well – after all they listed not even a year ago. Unless……investors have had a look now at the data, considered the challenges of rapid growth in the legal market…..and decided to sell.

As this site has noted before, the challenge of public listing is the high level of scrutiny you are under. Fund managers have a very serious duty of care to examine every aspect of your company and they are entirely unsentimental about selling a stock that isn’t performing as hoped.

But on the brighter side, just because all these prices are in the red now doesn’t mean that they won’t shoot back up at some point, even by the end of today.

What it shows however is the risks of getting hyped over share prices and valuations. So-called ‘unicorn’ valuations are very often a fantasy. Anyone can say X company should be worth Y amount. But, the real world tends to push back eventually.

What is surprising is that the pushback has happened so quickly for legal tech.

Is this the end of legal tech IPOs? Despite the above, there are probably half a dozen companies at this very moment preparing their listing documents for filing. It’s unlikely anything other than a full-scale market retreat will stop those companies currently planning to do their IPOs.

However, at least now the investors, and everyone else in the market, may have a more realistic picture of what may happen after a legal tech company lists.

1 Trackback / Pingback

Comments are closed.