Unlike the recent spate of legal tech listings that have often not done that well, listed law firms have mostly performed solidly over the last 12 months. Artificial Lawyer has a look at the figures and considers what they tell us.

Below are several listed law firms, all based in the UK. But, as you will see, some operate internationally.

DWF Group – DWF is a global legal business headquartered in Manchester with 31 offices across the world. In March 2019, DWF was listed on the London Stock Exchange. DWF is the UK’s largest listed law firm. It covers everything from commercial legal services to legal process work. It also has a strong focus on legal practice innovation.

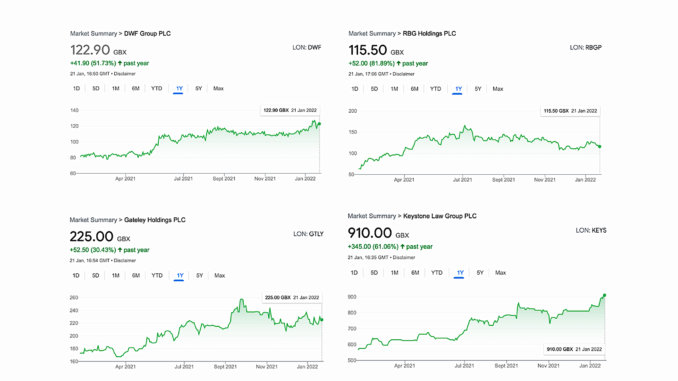

It’s doing well after a major drop during the first year of the pandemic. It’s a bit below its debut from back in 2019, but in the last 12 months has risen over 51%, which is healthy.

Knights Group Holdings – This listed firm, which also has several facets, covers everything from consumer law to commercial advice. It says of itself: ‘Knights Group Holdings plc is listed on the AIM market with an ambition for growth and success; clearly focused on becoming the leading legal and professional services business outside London.’

Over the last 12 months it’s come out even, i.e. at the same share price as it was before. However, over the long-term and since its IPO in 2018 it’s now up by over 134%.

The Ince Group – This group is also made up of many parts, including its founding firm Gordon Dadds. It also owns eLegal Technology Solutions, a tax consultancy, and the international shipping law firm, Ince. It notes that: ‘The Ince Group is a dynamic international legal and professional services business with offices in seven countries across Europe, Asia and the Middle East.’

Unlike the others, its share price has not done that well and is down around 7% in the last 12 months, despite the world seeing a surge in the demand for legal services.

Keystone Law Group – This is ‘a national law firm headquartered in London, with offices in several other countries, which offers legal services for business and individuals’.

And it’s done rather well, with the share price up 61% in the last 12 months. Moreover, since its debut in 2017 it has been on a steady rise, and is now up by 377% over the life of its listing.

Gateley Holdings – This is a general commercial law firm, and it’s also done well, up over 30% in the last 12 months and 123% up since its IPO. Again, another long-term good performer.

Rosenblatt Group – And finally, Rosenblatt or RBG Holdings, which is also doing well at 81% up over the last 12 months. Although, since its IPO in 2018 it’s been a bumpy road and until 2021 the share price had not done well. They also offer a mix of commercial and personal legal services, but they also have a litigation finance arm.

–

What Does it All Mean?

The firms above are not giants with £1bn revenues, but they are doing very well all the same. Demand for legal services seems to keep rising, on both the commercial and consumer ends of the spectrum, and that is feeding through to the share prices – at least for most of them.

Many of the above have also developed, or bought up, additional services, often focused on some form of professional advisory area, even if it’s not provided by lawyers. And again, the business world only ever seems to become more complex and more regulated – and so needs more input.

With tech who knows if a certain vendor will make good on its promises to grow massively, or remain technologically a leader in the field? With law firms, once they’ve made their reputation, it’s more a matter of keeping on going and steadily expanding and spreading their reach.

Of course, law firms do go bust from time to time, it’s true. And a law firm is a business that relies very much on its leading lawyers – if they walk away, then there isn’t much of a business left. In a tech company, even though investors would not like to see the founders leave, there would still be a hopefully very good product left to sell.

But, overall, law firms do seem to be favoured by investors at the moment. And that bodes well for Mishcon de Reya, a firm well-known for its innovation work, and which is also now heading down the public route.

The last point is what does this say about ALSPs and law companies? It would suggest that they would also do well as listed businesses at present, and Elevate for example, which now can offer legal services in the US as well, is understood to be contemplating going public, presumably via the UK. How many other ALSPs are currently thinking about going down the same path is not known, but perhaps that is a new trend that could emerge in the future?

—

[ All data via Google. Prices as of Friday, 21 Jan, 2022. Note: most charts set to 12 months to show recent performance, as the firms’ IPOs were in most cases several years ago.]

[Note: this is a news story about listed law firms. It is not investment advice. Anyone thinking of investing in another company should always take professional advice.]

Richard, nice snapshot of some publicly listed legal service providers here. I do not foresee many ALSPs attempting to go public until they also have legaltech products under their umbrella of offerings. Time will tell!