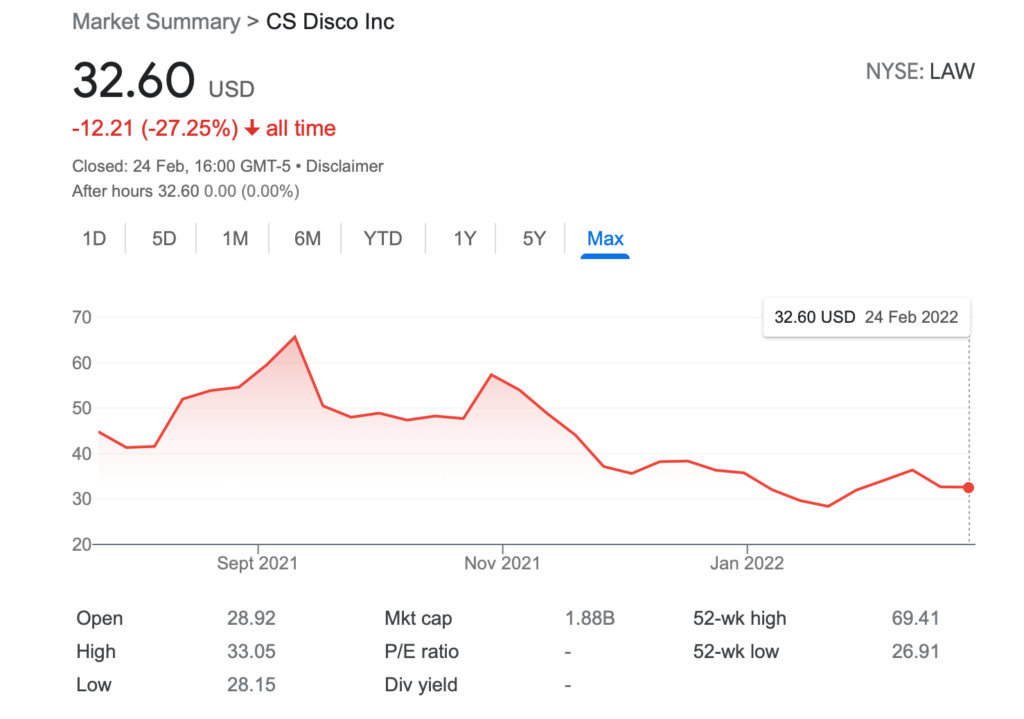

Publicly listed eDiscovery company DISCO has acquired the legal workflow products Hold360 and Request360, as well as related regulatory and alert solutions, from Congruity 360, a US-based data governance business. DISCO also reported last year’s total revenue was $114.3m, up 67% compared to fiscal year 2020, but with a net loss of $24.3m. Its share price also remains well below its debut.

The company said that: ‘With Hold360 and Request360, DISCO will expand its solution set to address the legal hold requirements of customers, including the ability to hold data and documents in place electronically rather than recreate, store, and manage copies of duplicative data.

‘Further, silent hold capabilities allow legal teams to easily enact holds, without the need to engage IT departments to ensure retention of sensitive information. The easy-to-deploy solutions and workflow allow corporate legal teams to save time and resources and improve their compliance with state and federal laws.’

DISCO Chief Product Officer, Kevin Smith, added: ‘We are excited to further demonstrate how great technology can empower legal teams, save time and money, increase efficiency, and ensure compliance. This also addresses the unmet needs of our legal services partners, many of whom have relied on legacy services to fill this critical gap for their customers.’

John Sanchez, founder of Hold360 and Request360, concluded: ‘We are excited to join the DISCO team and accelerate our contribution to transforming how legal work is done in the modern era.’

Meanwhile, DISCO has also announced its latest financial performance – which really matters more than ever now because it’s a publicly listed company. It reported that:

‘Fourth Quarter 2021 Financial Highlights:

- Total revenue was $33.8 million, up 76% compared to the fourth quarter of 2020.

- GAAP net loss was $9.1 million, compared to $3.0 million in the fourth quarter of 2020.

- Adjusted EBITDA was ($5.3) million, compared to ($2.1) million in the fourth quarter of 2020.

Fiscal Year 2021 Financial Highlights:

- Total revenue was $114.3 million, up 67% compared to fiscal year 2020.

- GAAP net loss was $24.3 million, compared to $22.9 million in fiscal year 2020.

- Adjusted EBITDA was ($16.3) million, compared to ($19.9) million in fiscal year 2020.’

However, as mentioned, its share price – although seeing an immediate bump from the good results, remains well below its debut. Part of this is due to sustained pressure on tech stocks in the US generally, but that said there are other tech stocks that have done well. This perhaps shows the challenges of publicly listing, i.e. DISCO appears to be growing at a rapid rate: it’s expanding its revenues, it’s acquiring new tech, and yet its publicly traded shares are below where some may have expected (see below).

Kiwi Camara, Co-Founder and CEO of DISCO, commented: ‘The legal industry is recognising that cloud-native technology and applied artificial intelligence are game changers. As we close on our first calendar year as a public company, we believe our results demonstrate that DISCO is at the forefront of the industry’s modernisation.

‘Our ability to empower our customers to achieve better legal outcomes continues to drive demand for our offerings, as law firms and corporate legal departments turn to DISCO for our product innovation, for our expertise, and to use technology to transform the practice of law.’

Overall, however one sees this data, the company does indeed appear to be on an upwards trajectory in terms of growth.