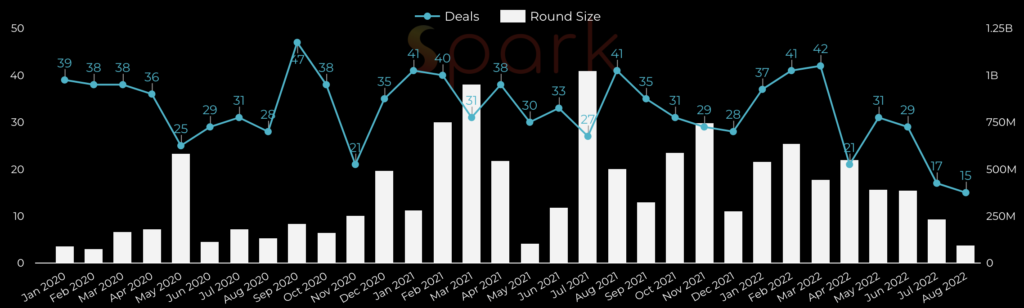

New data from Legal Complex shows a continued decline in both the number of investments into legal tech companies and also the total monthly value of deals, especially when compared to last year.

As shown in the chart below, which presents investment deals by volume (blue line) and also total value per month (white bars), the ‘bumpy’ period for legal tech companies that started from April this year is sustaining – and arguably getting worse.

For example, in the first month of Q3 this year, i.e. July, there were only 17 deals, in July 2021 there were 27 and in 2020 there were 31 investments into legal tech companies.

August data to the 25th of this month also paints a picture of relatively low numbers. Naturally we need to wait until we reach September to get the full Q3 picture, but as you can clearly see from the month-by-month data, funding activity is dropping off.

For example, across 2021, we saw a significant number of investment deals nearly every month, in some cases seeing around 40 deals per month, with that pattern continuing until March this year, after which everything seems to have changed.

Also, the total sum of the investment rounds this month up to the 25th August, for example, have collapsed compared to the same period in 2021. With about $96m this month to the 25th, with the comparable timeframe last year seeing around $445m invested. As noted, we need to see the full Q3 results to understand the complete picture and these results are only indicative for now, but if this pattern continues then the full Q3 could end up as a notable low point for legal tech investments.

Why is this happening? And what happens next?

As explored in previous Artificial Lawyer articles, the software market has been hit by several factors all at once, which has included a general decline in listed tech company stocks and a steep drop in SaaS business valuations, plus a macro-economic background of high inflation and an impending recession.

Also as noted before, the painful irony here is that in many ways the outlook for legal tech products has never been better, as more law firms and more inhouse legal teams engage with a range of issues: from work-life balance, to better use of legal data, to improving KM resources, to driving efficiency in routine processes – all of which can benefit from legal tech tools.

Once again, the wider market seems to be moving out of step with the reality on the ground. But, if funds won’t spend there are not many options legal tech companies have but to keep on going and focus on increasing income by winning new clients so that organic revenue generation drives them forward.

(Of course, one other solution is to go for a merger and join a larger business. Not all of the recent spate of acquisitions in the legal tech field have been driven by a funding challenge – but it certainly must be on the minds of several founders right now.)

Looking ahead, as mentioned, we still need to wait for the full September data to come in before seeing just how bad Q3 has been. That said, this site and no doubt many others expected to see funding announcements appear during ILTA week – and very few have. It’s possible (i.e. possible, but not probable) that loads of companies are saving up their huge funding announcements for next month and there will be a bumper crop of them that lifts Q3 back upwards again.

Equally, the bumpy trend may well continue, perhaps into 2023.

The following point is that while some companies can ride out the next quarter without having to go back to the VC world for a new round of ‘runway’ cash, even if they have to stretch things a bit, if this drags on into 2023 then a lot of legal tech businesses are going to be searching for cash at a tricky time, as they tend to move to a new round every year or two.

Let’s hope that the wider market realises that legal tech is in fact a very good bet that goes against the wider macro picture. Plus, it’s worth adding that 1) the total number of lawyers in the world only ever seems to increase, and 2) the legal and compliance needs of corporates only ever seem to increase as well. That’s a market where the long-term picture for selling software that helps lawyers has a very rosy outlook.

Commenting on the results, Raymond Blijd, CEO at Legal Complex, said: ‘As noted earlier, the drop in funding this year is continuing. Current Q3 is down significantly compared to August last year. However, signs indicate that 2021 was an anomaly with record-setting funding of legal tech. The elephant in the room is the impending recession. This has curbed spending in most sectors, and this behaviour has prompted new trends for the legal industry.

‘Case in point: investment in procurement and legal spend analytics for corporate counsel is steadily increasing, while legal fees from the IPO market have vanished this year. Similarly, fees for startup fundraising are hard to find. Meanwhile, the venture and private equity fundraising world is setting new records. This July alone, we captured 115 funds raising a staggering $164 billion.’

This last point is fascinating as it shows there is in fact plenty of money out there – it’s just that the funds are not dishing it out at the current time.

1 Trackback / Pingback

Comments are closed.