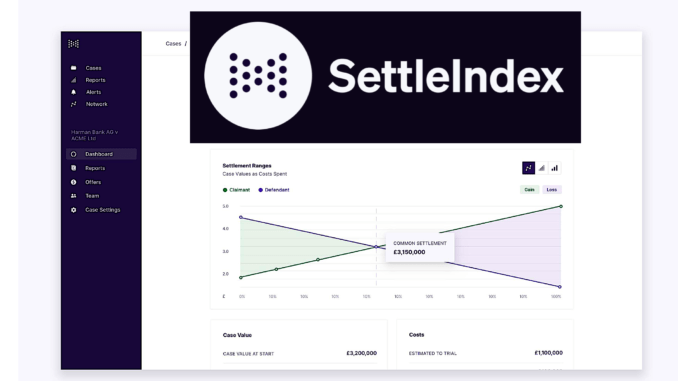

Meet SettleIndex, a new risk and decision analysis platform that enables lawyers and clients to assess, track and analyse litigation. It has been co-founded by Robert Hogarth, a former Senior Partner at UK law firm RPC, and Zac Best, a digital products expert.

At its core it provides data-driven financial modelling for dispute resolution and is focused on law firms, corporates and insurers. Sounds useful. How does it work?

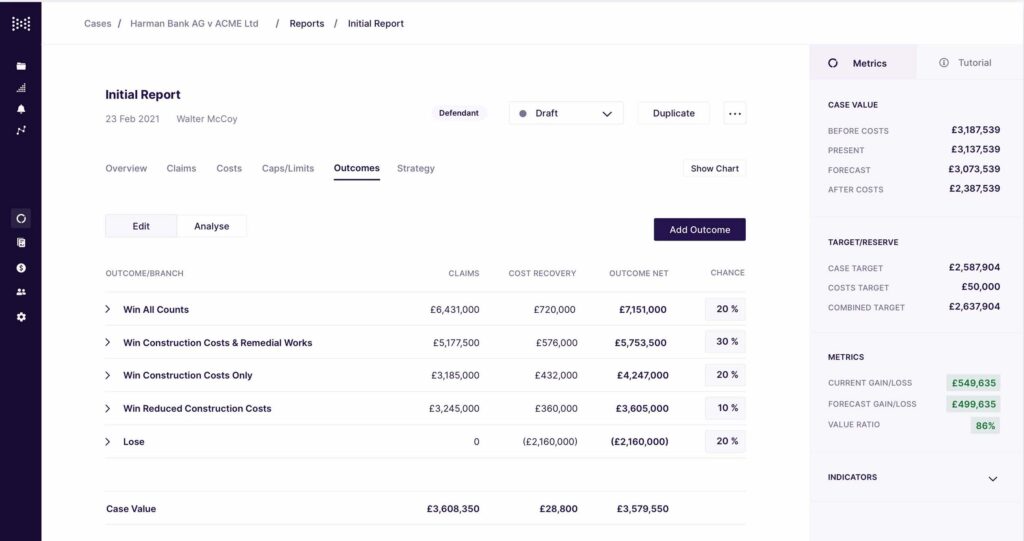

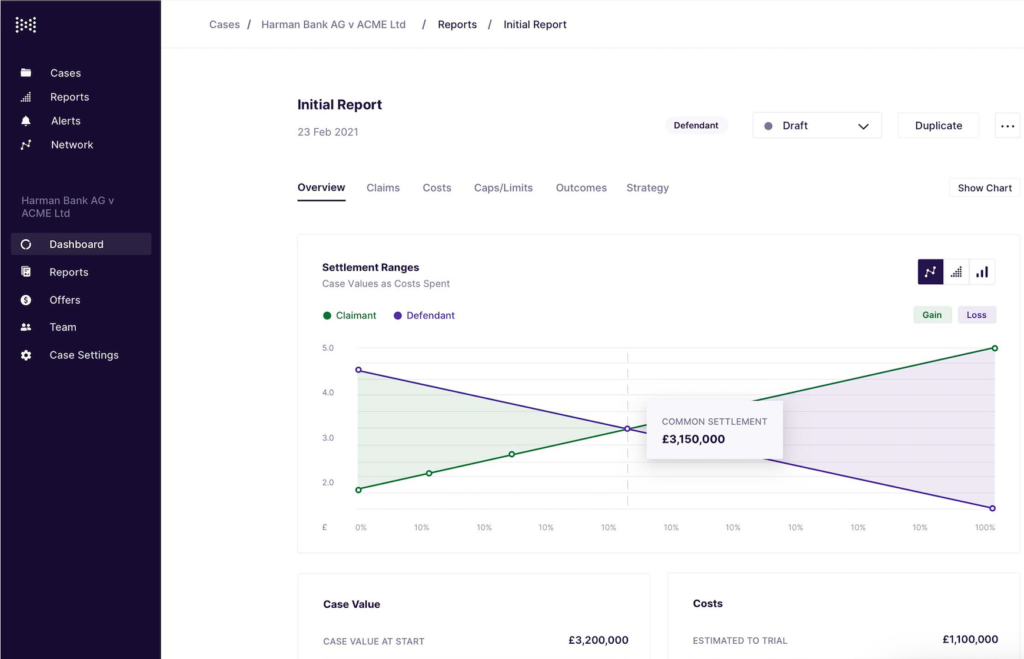

‘Based on the principles of decision analysis, the software augments lawyers’ professional judgment, enabling them to model potential outcomes, simulate opponent viewpoints, and evaluate settlement strategies,’ the company explained.

The SettleIndex platform also provides the monitoring of cases and collecting structured data on litigation. In turn the financial modelling creates a range of metrics and performance indicators that law firms and clients can use to see case progress and the ability retrospectively to audit decision-making.

And, over time, clients can build up proprietary structured data sets to inform future litigation strategy and measure performance.

This makes a lot of sense. Law firms and clients have plenty of litigation data, the challenge is getting it into a format where it can be made useful. In short, this is what SettleIndex does.

Co-Founder Hogarth, who worked at RPC for over 38 years, noted: ‘Financial modelling is a crucial part of every financial dispute. To advise a client properly on settlement, you need to know what a case is worth. With SettleIndex, lawyers can communicate the financial risks involved in a dispute and work better with their clients. We want to take financial analysis from a niche activity to something that’s mainstream in litigation by making it simple, intuitive and powerful.’

Moreover, fellow Co-Founder Best, added: ‘Law firms are increasingly turning to data to inform litigation strategy, but over 90% of cases are settled privately, and structured data often isn’t collected. SettleIndex empowers clients to build up invaluable comparative data across cases for future decision-making.’

Artificial Lawyer asked: what was the inspiration for this? Hogarth told this site: ‘I made financial models of increasing complexity over the last 20 years of my litigation practice. It was clear to me that proper use of modelling is a genuine aid to productivity, shortening the length and reducing the cost of litigation.

‘I could not understand why all lawyers were not doing it for their clients as a matter of course. Then after I became a mediator, I realised that unless somebody built the software there would never be any progress.’

Given Hogarth’s time at RPC, the company also has a focus on the insurance market, which as they point out, is one of the largest buyers of litigation services. In fact, last year, the firm was selected from over 177 applications to participate in Lloyd’s Lab, Lloyd’s of London’s highly regarded innovation accelerator, plus the product is already in pilot with a multinational insurance firm.

All in all, this looks like it will be a very useful addition to the litigation analytics field. Central to its value will be inputting data into the system to enable it to provide the insights it can potentially produce. But, hopefully once firms and clients see the benefits of a more data-driven litigation strategy this product may become a key part of their normal processes.

1 Trackback / Pingback

Comments are closed.