By David Fisher, Founder, Integra Ledger.

This is the second instalment in a four-part series that explains the Integra Ledger ecosystem for universal document and contract automation.

In the first instalment in this series, we introduced the concept of ‘document credentials’ – things like permissions and logic that can be bound to a document via the document’s unique ID registered on the Integra Ledger blockchain. In this second instalment, we’re going to explain how document credentials work and the implications for the legal industry and wider world.

It’s useful to begin by considering the history of credit cards and comparing that history to the legal industry’s current use of documents and related technologies. Today, we experience credit cards as the convenient technology that allows us to instantly transfer money to vendors, worldwide. It wasn’t always that way, obviously.

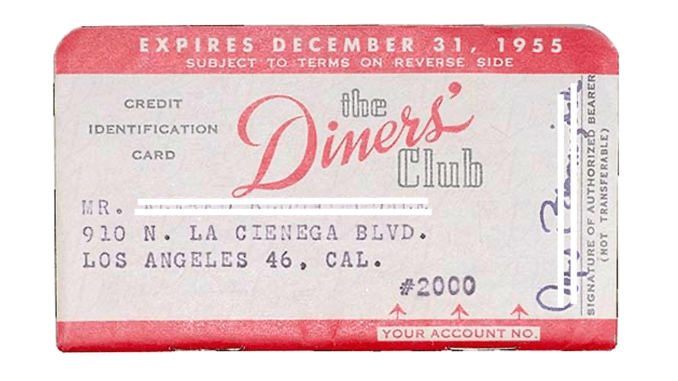

In their early form, ‘credit cards’ were just pieces of paper, such as Diners Club:

No magnetic stripe or smart chip – just a signature that could be compared to the signature of the person presenting the card. Those of us of a certain age will remember that credit cards, once they transitioned from paper to embossed plastic, had to be placed in a manual machine to take an imprint of the card on several layers of thin paper with carbon sheets in between.

The merchant would typically look up the card number in something that resembled a phone directory to ensure that the card number was valid, and at the close of business the merchant would submit the paper copies to it bank for manual reconciliation. Obviously, the entire system is now fully automated with nearly instant validation, funds transfer, and reconciliation.

That history lesson actually describes the evolution of identity technology, more than just the credit cards. The better the identity technology, the more efficient the whole system. Today, billions of decentralized customers and merchants all over the world complete over one billion transactions per day, and it works so well because the identity of customer and merchant can be confirmed at the point of sale. No need to consult paper directories of valid numbers. No need to manually compare signatures to confirm customer identity. No need for the merchant to manually enter and reconcile thousands or even millions of transactions.

Today, when a customer presents a credit card, he or she is not providing key personal details to the merchant. The credit card is actually functioning as a ‘digital wallet’ (to use a blockchain term) with authentication features – the magnetic stripe, smart chip, and customer PIN – and when the customer confirms his or her identity by sliding or tapping the card, he or she is actually just authorizing the transfer of information between the institutions involved in the payments network.

LegalTech for documents and contracts in 2022 resembles the Diners Club in 1958 – pieces of paper, including in digital form such as PDFs, with signatures on it. They can be passed from one person to another (typically by email), but there is no automation equivalent to a magnetic stripe or smart chip that would allow the contract to be validated and critical information transferred from one party to another, with multiple organizations on the back end doing the heavy lifting for automation, information transfer, and even value transfer. Yes, there are various document and contract management systems that can perform limited interactions with third parties, but there is no universal equivalent for global payments networks.

Integra has been building the global equivalent to the credit card payments network but applied to documents and contracts, and the Integra Wallet functions in a way that is similar to a modern credit card with smart chip. When you present a document to a counterparty of any type, the users’ Integra Wallets can interact with each other to authorize the transfer of related information that is not embedded in the document itself, for privacy and security reasons. This is similar to a customer who presents a credit card for a purchase – the customer has no need to link his or her accounts to the merchant. The back-end institutions use the customer validation at the point of sale to initiate extremely complex flows of information and value.

By contrast, the current paradigm in the legal industry is to link proprietary systems in one way or another (portals, cloud intermediary software, etc.). Imagine if customers and merchants had to navigate thousands of different payment networks in order to perform what we now consider to be almost a human right – instantaneous buy-sell transactions, worldwide!

Here’s how the world’s legal industry can achieve universal document and contract automation, following the proven pattern of the world’s credit card processing system:

- The Integra Wallet holds user credentials – proof of identity – with technology similar to a credit card with a smart chip. Instead of a PIN, there is a pass phrase or private key known only to the wallet user.

- A law firm or organization (or law society/bar association) can issue a revocable ‘credential’ to a user’s wallet, much in the way they already issue email addresses. As a convenience, Integra Wallet technology can be linked to Microsoft Active Directory for full integration into organizations’ existing identity management systems.

- A user (with an Integra Wallet) can register a document on the Integra Ledger blockchain. Registration entails the user generating a large random number (numbers are not ‘issued’ by Integra), embedding the number in the metadata of the document, and then posting the number and the associated document hash on Integra. The result is an external time and date stamped proof of existence for the privately helddocument. Nobody other than the owner of the document will know what the entry on Integra Ledger refers to.

- Also stored in the document before it is registered is a web endpoint to request document credentials, hosted by the user’s employer. For example: credentials.majorlawfirm.com.

- This is extremely important – there is no central directory of wallet users and their identities. Additionally, the document owner’s identity is not even included in the document. The only outside information added to the document is the random number ID, which allows the recipient to prove existence and authenticity, and the general address to request additional information about the document.

- Next, the user can use his or her Integra Wallet to send a connection request to the credentials endpoint embedded in the document, exposing only a dynamically generated random ID for the session (not even the wallet/user ID) and the document ID.

- The firm that receives the connection requestion for the document can then ask for the requester to provide verified credentials – things like name, email address, and any employer credentials stored in the user’s wallet.

- Once that digital ‘handshake’ has been completed, both sides can begin exchanging additional privileged information about the document, such as structured data, document logic, payment details, private information, and even related documents. The Integra Wallet manages the exchange of credentials and nothing more. This is accomplished peer-to-peer, without the involvement of any intermediary.

The extraordinary consequence of this technology pattern is that organization-to-organization document automation becomes universal and ad hoc down to the individual document level. It is analogous to the universal acceptance and use of credit cards, made possible by a common system of authentication that doesn’t require a central intermediary to hold everyone’s identity information and private information.

Private, peer-to-peer, ad hoc document and contract automation that is software agnostic will enable related technologies such as ad hoc universal document encryption, document messaging (e.g. sending an invoice to a document, removing the need for manual reconciliation), privately broadcasting document messages (e.g. legal notices, amendments, etc.) that will be intrinsically linked to predecessor documents and securely delivered to individuals and organizations whose wallets have previously exchanged the credentials.

As the technology becomes ubiquitous, everything described above (credential request and exchange) will become automated and invisible to the average user, much like credit cards. It will just work. In the credit card example, it works so well that now over a billion transactions per day are automated between billions of disparate parties. The same experience is coming to document and contract automation.

Stay tuned for the 3rd instalment in this series, coming next week, as continue our deep dive into the coming universalisation of document and contract technology.

–

About the author: David Fisher is the founder of Integra Ledger, ‘the blockchain for law’, as well as the founder of the Global Legal Hackathon, which is the largest legal innovation event in the world.

–

[ Artificial Lawyer is proud to bring you this sponsored article by Integra Ledger. ]

1 Trackback / Pingback

Comments are closed.